Part Eight: Trusts

The words “trust fund baby” conjure up an image of a spoiled silver-spooner with no responsibilities. But there are currently between 300,000 and 500,000 trusts in our country of 1.5 million families, which would suggest that trust funds are much more common than we might think (New Zealand Ministry of Justice).

But what is a trust? Why are they so popular here? And is it something for you to explore?

Trust us as we take you on a crash course of trusts (sorry, we couldn’t resist a pun).

🚨 Denotes parent-specific points in our guide.

Trusts 101

Definition of a Trust

A trust holds assets that are managed for the benefit of one or more person(s). Assets can include real estate, cash and investments.

The rules governing how a trust is run are contained in a trust deed and the Trusts Act 2019.

Different Roles in a Trust

There’s a fair bit of jargon here, so bear with us.

Settlor (they put the $$$ in and make the rules!)

The settlor is the person who creates the trust. This means:

They make the initial transfer of assets, which can be as little as $1. Once the settlor transfers assets to the trustees, they are no longer the owner of those assets - the trustees are.

They determine the terms of the trust deed, i.e. the rules that govern the trust.

Trustee (they are the stewards and gatekeepers)

The trustee holds title to the assets of the trust, and they manage and deal with the assets per the terms of the trust deed. Trustees have many duties, including:

Dealing with trust assets that are in the best interests of the beneficiaries

Knowing the terms of the trust and acting in accordance with those terms

Exercising their powers for a proper purpose

Acting honestly and in good faith

Not profiting from the trust

Beneficiary (aka the “trust fund baby”!)

The beneficiaries are those to be provided for and to benefit financially from the trust.

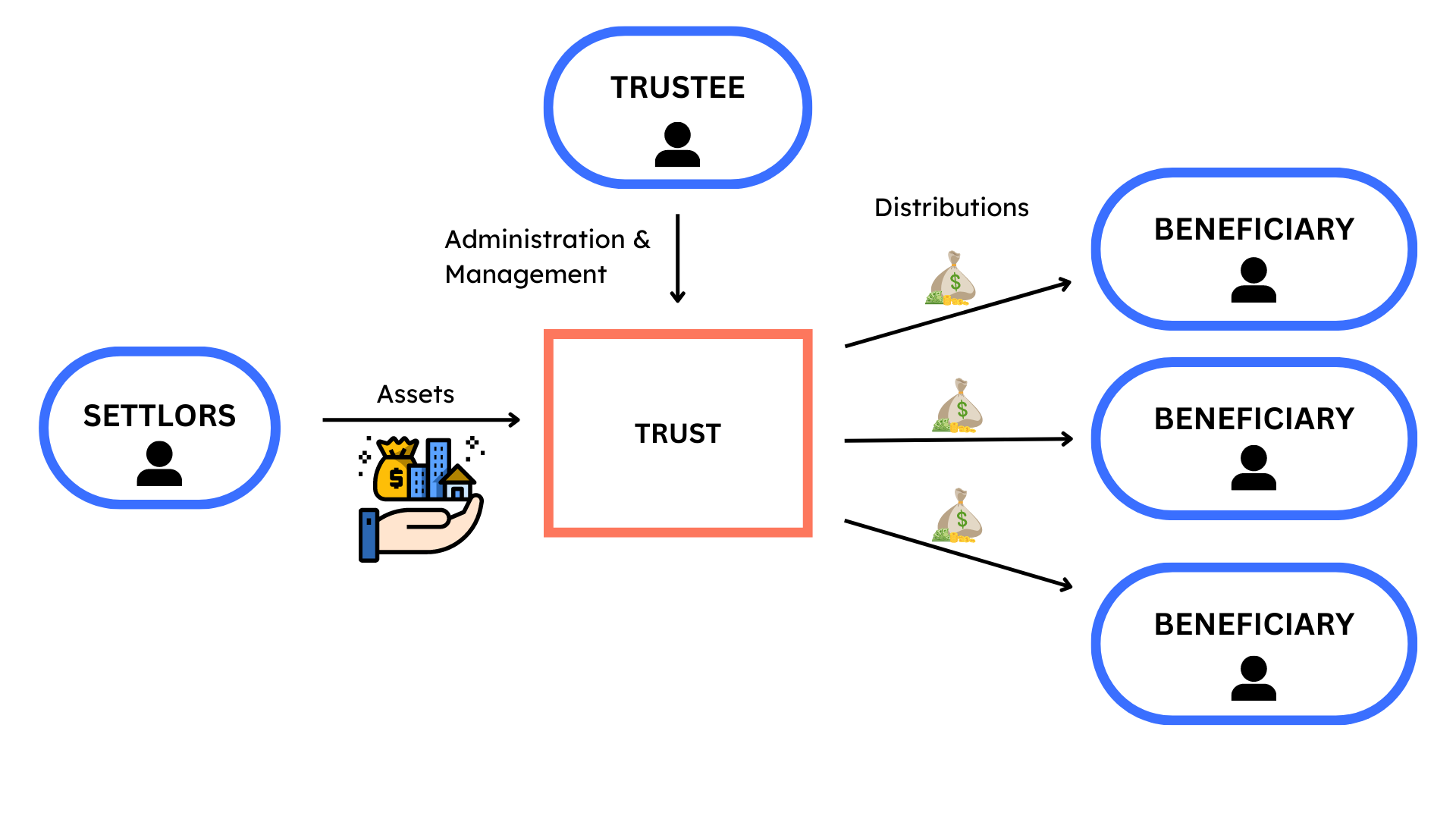

In summary, there are three distinct roles in a trust arrangement:

The party that provides the assets (the settlors)

The party that manages the assets (the trustees)

The party with a right to benefit from the assets (the beneficiaries)

There can be more than one settlor, trustee and beneficiary of a trust. And to make it more confusing, the same person can also hold all three roles.

Trusts in New Zealand

Trusts have been a part of the “traditional” approach to asset planning for some time in New Zealand. You might be a party to a trust or know someone who is.

Many trusts have been poorly managed and governed, which could be problematic if their validity was ever challenged in court. If a trust is a part of your asset and estate plan, then you need to ensure it is properly governed and administered to reap the benefits of having a trust. This means:

Appointing professional, independent trustees who are specialists in trusts governance and administration

Convening regular trustee meetings

Ensuring all trustee decisions are documented in a resolution or meeting minute

Complying with applicable laws and compliance requirements (of which there are many)

Maintaining a minute book of all important trust documents.

Is a trust right for me?

Trusts may add unnecessary complexity and expense to your life, so it’s not a decision to take lightly. We’ve included a list of common reasons a trust might be appropriate for parents, but it’s by no means exhaustive.

🚨 Providing for your children’s future

Intergenerational wealth

You know what they say: the first generation makes it, the second generation spends it, and the third generation blows it.

This is where a trust is useful. A family can use a trust to manage the transition of wealth between generations. All family members can be included as beneficiaries of the trust and receive benefits at certain stages of their lives. The settlors of the trust (reminder: the people who tip the money into the trust, typically the patriarch or matriarch of the family) can express their wishes to the trustees regarding how and when beneficiaries benefit from the trust. Whilst these wishes are not legally binding, they are persuasive and should be considered by the trustees when making decisions.

Provide for children

Trusts are a useful way to provide for children in the event of separation, divorce or death in a relationship.

Education

Families may use trusts to manage and provide for their children’s educational futures specifically.

Homeownership

It is common for parents and/or grandparents to establish a trust to provide funds to be used as a deposit for a home, a loan, or other financial support to future generations. Doing it this way ensures it is used responsibly and protected from risk. You can read more here.

Care of vulnerable persons

Trusts are widely used to set aside funds to ensure the care of vulnerable persons in a family or community, such as someone with disabilities or dementia. This is increasingly relevant as people are, on average, living longer.

Protection from risks

Creditor risk

A trust may be able to protect assets from creditor claims, such as bankruptcy. However, people often overstate the risk of a claim from a creditor. Instead of creating a trust, their time and resources are better spent alleviating any risk by ensuring their business (or the source of risk) is properly managed and controlled. Adequate insurance policies, such as director and officer insurance, can also provide protection.

Relationship property claims

Trusts are not the most effective way to have protection from a partner/spouse making a relationship property claim. If your primary goal is to protect assets from a relationship property claim, then a relationship property agreement should be entered into. Check out our article on relationship property.

Other common reasons

🚨 Family business

It is common to use trusts (or, more likely, a company owned by a trust) to carry out a family business. This can be helpful for succession planning by facilitating the transition of ownership and control between generations whilst maintaining a solid voting bloc.

Tax

While tax advantages are associated with establishing a trust, these have diminished over the years. One of the most widely known advantages is the ability to distribute trust income amongst the trust’s beneficiaries with lower marginal tax rates. This can reduce the effective tax rate of the trust.

However, to enjoy this benefit, the trust must actually distribute its income to the beneficiaries who are on lower tax rates rather than retain it as trust income or distribute it to other beneficiaries who are on higher tax rates. This might not be in the best interests of the beneficiaries. Also, the costs associated with having a trust might exceed the tax savings.

Exploring trusts further

If you’re interested in taking this further, it is probably worth discussing it with your legal advisor. Before rushing to set up a trust, ask your legal advisor and accountant to consider and explain to you:

What will be the ongoing, regular costs associated with the trust, e.g., trustee fees, legal fees, accounting fees, and compliance costs?

Who will maintain the trust minute book, which includes copies of all important trust documents?

What additional documents need to be prepared, e.g. new wills, a letter of wishes for the trust?

What information needs to be disclosed to the beneficiaries of the trust? The law changed in 2020, and now beneficiaries have a right to receive certain information about trusts they are a beneficiary of.

Will the trust need to prepare financial statements?

Will the trust earn income and therefore have income tax filing obligations with the IRD?

Does the trust have financial disclosure obligations to the IRD?

Are any of the beneficiaries a tax resident outside of New Zealand? If so, additional reporting obligations may exist.

Are there any adverse tax consequences with transferring assets into the trust? For example, transferring your family bach into the trust may create a tax obligation to the IRD.

Setting up a trust can be complex, and a number of factors need to be considered. Keep in mind that all the assets you put into the trust will no longer be in your name and, therefore, no longer under your direct control. It will be up to the trustees to manage those assets in a way that is in the best interests of all beneficiaries (which could include you). With this in mind, carefully and strategically consider, with your legal advisor, whether a trust should form part of your asset and estate plan before setting one up.

This is part of Crayon’s mini-series on asset and estate planning for parents:

Now for the important legal part: The information we provide is general and not regulated financial advice for the purposes of the Financial Markets Conduct Act 2013. Please seek independent legal, financial, tax or other advice in considering whether the content in this article is appropriate for your goals, situation or needs. The information in this article is current as at 18 January 2023.

All of our content is independent. Crayon provides you with accurate and valuable information you can use to make smart money moves for your family. We work with people we respect, and all collaborations are unpaid.

Sarah Kelly

Senior Associate, Private Wealth team at Dentons Kensington Swan

Stephanie Pow

Founder and CEO, Crayon