Part Two: Fundamentals of Long-term Investing

This is the second article in Crayon’s mini-series on investing for your kids. Throughout this series, we’ll explore how it could work for your family and give you a few tips from our experts to make it easy, actionable and effective.

For many of us, “investing” conjures the image of people shouting “buy, buy, buy!” in the film Trading Places, or a broker pushing a questionable ‘hot’ stock in The Wolf of Wall Street. It looks aggressive, risky and not at all family-friendly.

But neither is a true or helpful reflection of a good long-term investor. And by long-term, we mean investing with at least a five-year timeframe (don’t worry - if you need the money earlier, most investments allow you to get your money out at any time).

In fact, a straightforward approach to investing for your kids comes down to just three guidelines: start early, invest small amounts regularly and stay the course.

1. Start as early as possible

Business headlines often focus on the daily highs and lows of investing. What’s not as newsworthy - but far more reliable for our kids - is the value of time: something kids have in spades! We touched on this concept in Part One, and it’s important to revisit it because the length of an investment is critical to realising its greatest value.

This Q+A demonstrates how this unfolds:

Q: Which investment gives you a higher return?

Investment A generates returns of 10% per year for 3 years

Investment B generates returns of 5% per year for 6 years

A: You would get a higher return from investment B — half the return, but double the time.

The power lies in the simple science of compound returns (also referred to as compound interest).

What are compound returns?

Compound returns are where you earn returns on the amount you invested and on your previous returns. It works like a snowball - to begin with, it’s only a small part of your investment return, but over time it gains momentum. Here’s an example of compounding at work:

You invest $100 when your child is born, and the investment earns 10% each year:

When your child turns one, your investment has generated $10 in total returns (10% return on your original investment for one year).

When your child turns two, your investment has generated $21 in total returns (10% return on your original investment for two years plus 10% return on the $10 you earned last year).

As your child grows up, they keep earning returns on returns. By the time they reach 10 years old, the $100 investment has generated $159 in total returns.

One of my favourite finance writers Morgan Housel has a good blog post explaining the power of compounding if you’d like to read more.

2. Invest small amounts, regularly

There will always be a pundit predicting an outcome, and another predicting the absolute opposite.

Not only is it notoriously difficult to pick the best time to invest, but our instincts often lead us to make poor decisions. When we try to pick the market, many of us can end up buying high and selling low.

A far more reliable approach is to invest regularly - sometimes you’ll invest when the market is a bit higher, and sometimes you’ll invest when it’s a bit lower. While the share market can be very volatile in the short run (as we’ve been experiencing this year), it has trended upwards in the long run. The proof of this approach is in the pudding:

One of the most followed share market barometers is the S&P 500 Index. If you had invested $100 when it started in 1926 and left it alone, your investment would be valued at $1.2M in 2022 - even after enduring the Great Depression, World War II, the 2000s tech bubble burst, the Global Financial Crisis and the Covid-19 pandemic (officialdata.org).

On a more relatable scale, I was born in 1987, a few months before the share market crash known as Black Monday. I graduated from university in 2008, towards the end of the Global Financial Crisis. Had my parents invested $25 every month during this period (totalling $6,525), it would have been worth just shy of $10,000 upon my graduation - despite being bookended by two major economic disasters.

It’s important to note that this information works on the two fundamental presumptions:

First, investors hold onto their investments in the good and bad times. We talk about this more below.

Second, investors have a diversified investment portfolio. We’ll cover the importance of diversification and how to apply it to your investments in the next part of our series.

3. Stay the course

It’s natural to feel a pit form in your stomach when you see your investments fall in value - particularly when you’ve worked so hard to invest for your child’s future. In fact, humans feel losses twice as keenly as we feel gains. But one of the most destructive moves you can make is selling in reaction to a drop.

“Your money is like soap. The more you handle it, the less you have.”

Global investment company Vanguard found that the greatest value a financial advisor adds isn’t access to superior investments or tax-efficient structures but “behavioural coaching”, i.e. talking people out of making bad decisions. A good advisor acts as an emotional circuit breaker to warn clients from chasing hot trends (hello, crypto) or panic selling in a downturn (hello, COVID-19 in March 2020).

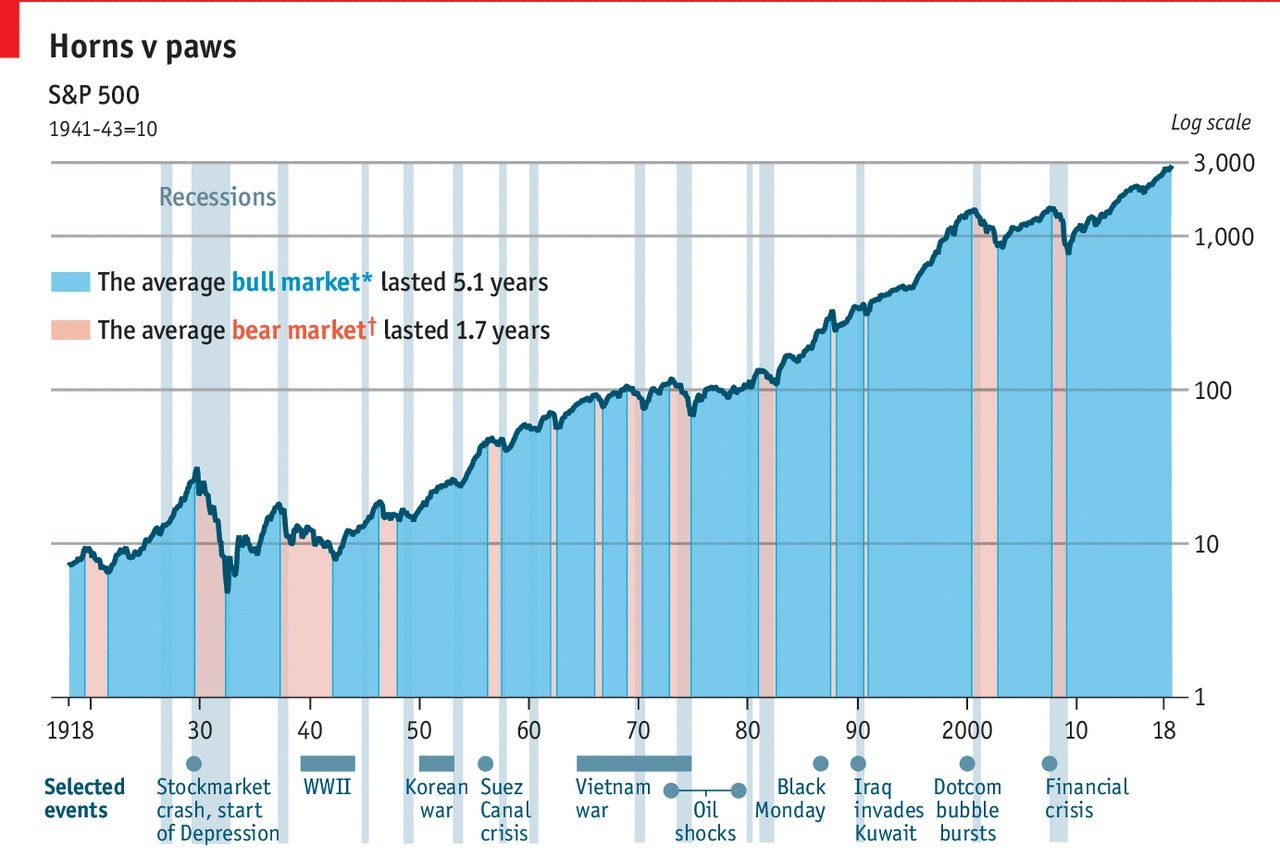

The table below should give you some comfort in this theory. It shows the bull and bear markets of the S&P 500 Index over the last 100 years.

-

Bull market: periods when share prices are going up. If you hold shares, you’re making money - happy days (blue in the chart above)

Bear market: periods when the sharemarket experiences sustained price declines of 20% or more from recent highs. There is generally widespread pessimism (orange in the chart above)

Source: The Economist

The key takeaways from 100 years of share market data:

Over time, the share market has gone up. The average return has been 10% each year before taxes, fees and inflation.

But that has come with significant dips along the way, and at times investors have seen their investments potentially halve in value, at least temporarily (this can last for some time too - for example, if you had invested at the very top of the share market right before the Global Financial Crisis in 2007, it would have taken you four years to recover the original value of your investment)

Even though negative events stick in our mind, the good times (aka bull markets) last longer. Many of us have heard of the Great Depression, the 1987 crash and the Global Financial Crisis - but we don’t even have names for the prolonged bull markets! Our brains have been hardwired by evolution to fixate on the bad.

All of this is to say investing in the share market is better suited for long-term goals, with a minimum timeframe of at least five years. And don’t panic - if you haven’t sold, you haven’t locked in losses, so if your child doesn’t need the money yet, don’t sell.

Get Ready!

If all of this intel is compelling you to consider investing in shares for your kids, we’re just getting started! In Part Three, we explore the three ways you can invest in shares and what to consider when selecting the right approach for your family.

And if you haven’t already, have a play with the Crayon Kids Investment Simulator to see what regularly investing could mean for your child.

This is part of Crayon’s mini-series on investing in shares for your child:

Now for the important legal part: Investing involves risk. You aren’t guaranteed to make money and you might lose the money you start with. The information we provide is general and not regulated financial advice for the purposes of the Financial Markets Conduct Act 2013. Please seek independent legal, financial, tax or other advice in considering whether the content in this article is appropriate for your goals, situation or needs. The information in this article is current as at 25 October 2022.

Stephanie Pow

Founder and CEO, Crayon