Investing For Your Kids: What Should You Do?

This article was created in collaboration with Rupert Carlyon, the founder of KiwiSaver provider kōura and father-of-three.

If you’re reading this, you’re probably one of those forward-thinking parents contemplating the best way to set aside a nest egg for your little ones. Let’s take this journey together. When you first hold your child, it’s like looking at a blank canvas that’s pulsating with potential. As a parent, you want to provide your child with the best opportunities – and this starts with ensuring a solid financial future.

The good news is that time is on your side. You don’t have to start big, and there are many options to choose from. Read to learn more.

Small drops make a mighty ocean

Let's start by addressing a common misconception: you don't need a hefty sum to begin investing. Think of it as planting a seed. You may start with something small, but given the right conditions and enough time, it can grow into a towering tree.

When it comes to investing, ‘time in the market’ beats timing the market. And as a parent saving for their child, time really is on your side.

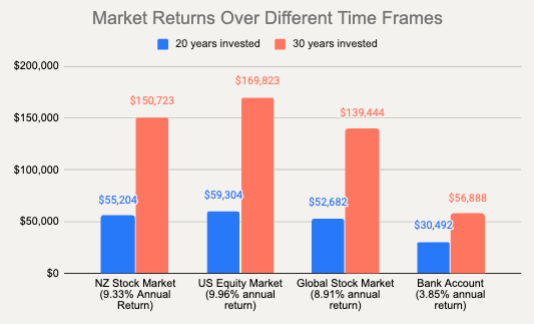

A modest sum of $20 a week may not seem like much in the short term, but if we fast forward 30 years, this small act of disciplined saving can yield impressive results. Invested wisely, it could mature into a substantial $170,000 at the end, dwarfing the $56,000 you’d accumulate by putting the same amount into a regular bank account.

That’s the magic of compounding returns. It means that your money earns returns, and then you earn returns on the returns – the financial equivalent of a snowball rolling down a hill, gathering momentum and mass. And while markets have their peaks and troughs, historical trends show one crucial fact: over time, investments are likely to grow.

Lots of different options for doing it

Here’s the fun bit. There are several avenues to explore, each with its own pros and cons. Let’s delve into it.

Direct equities

One of the options is to invest directly in individual shares. By doing so, you get a slice of the corporate world and get to participate in a company’s journey with its ups and downs.

While this offers the potential for high returns, it’s not a ‘set and forget’ solution. You need to stay on top of your portfolio and manage it on an ongoing basis. Also, it’s difficult to make it work with a small sum. For example, with a budget of $20 per week, transaction costs could be a stumbling block to diversification.

KiwiSaver

For an easier and more hands-off solution, KiwiSaver could be an option. Think of it as a dependable old mate: it’s low maintenance, easy to understand, and happily chugs along without constant supervision. You can invest small amounts regularly, and it won’t burden you with transaction fees.

The drawback? Its rules are quite strict: you can only access the funds for a first home or retirement. So, if in the future your child doesn’t use it to enter the property market, they will need to wait until age 65 (or even longer if the retirement age changes). A big world awaits your child, be it travelling or starting a business, and KiwiSaver may limit their wings.

With KiwiSaver, it’s likely you’ll want to put the investment under your child’s name since you’re saving for their first home or retirement (and not yours!). This means that you, as a parent, will lose control of your child’s KiwiSaver when they turn 18. It’s not necessarily a problem per se, but something to consider.

All that said, KiwiSaver can still be a good option depending on your goals, as it’s low cost and stable and a great way of dealing with small amounts. You can also consider mixing it with other investment vehicles for a bit of diversification.

Managed funds

Platforms like InvestNow or Sharesies offer easy, user-friendly access to managed funds. Picture a managed fund as a basket filled with a diverse array of assets – like a mix of shares, bonds, or commodities from across the globe.

Unlike KiwiSaver, your child will be able to access their funds at any point in time and use them for any goals they might have. And unlike picking individual shares, your weekly $20 is not just going into a single investment but is spread out across all these different assets. This helps reduce your overall risk, as your investment isn’t reliant on the success of a single company or sector.

If you find a global investment fund, you can potentially participate in different economies and industries. You are no longer just a Kiwi investor but a global one, and this allows you to diversify within a single investment option.

The other key choice is between active and passive fund managers. Generally speaking, from a long-term perspective, opting for a passively managed fund can be beneficial. Passive funds aim to replicate the performance of a particular index or benchmark; in short, they let the market do the work while you sit back and let your investment grow. You don’t need to worry about the fund manager making any dramatic changes to the investment strategy, and the fees are generally lower than actively managed funds.

Exchange-Traded Funds (ETFs)

ETFs are somewhat similar to managed funds but with a twist. They can be thought of as investment bundles that you can buy and sell on the sharemarket.

Imagine you're buying a pre-packed grocery box instead of selecting each item individually. Each of these 'boxes', or ETFs, contains a collection of different investments like pieces of various companies, industries, or bonds and shares.

When you buy an ETF, you're purchasing a small part of many different assets simultaneously, creating a diversified portfolio. This approach can reduce your risk significantly, as your investment isn’t tied to the performance of a single company or industry.

Up to this point, ETFs work similarly to managed funds. But here’s where things get different. As their name suggests, ETFs are traded on an exchange, much like individual shares, allowing investors to buy or sell them as units throughout the trading day.

Now, because there’s a cost associated with buying and selling these units, if you’re investing smaller sums (like $20 per week), these fees may chip away at your investment over time. Also, while in a managed fund, you can invest any amount you wish; with ETFs, you buy whole units. So if an ETF costs more than $20, you might have to adjust your investment budget.

Bank account

Finally, there's the tried-and-true savings account at your local bank. With a savings account, the path to building that nest egg for your child is as straightforward as it gets. Just deposit your savings, watch the balance grow over time, and rest easy knowing your money is safe. It’s a no-fuss, hassle-free way to save – and you can access your funds whenever you need.

However, the flip side of the safety and simplicity is the low return on investments. Savings account interest rates are typically quite low, often lower than the rate of inflation. This means that, over time, the value of your savings might not keep pace with rising costs. So, while a bank savings account is a safe place to keep your money, it may not be the most effective way to save for your child over the long term.

Mastering the rules of investing

As with any journey, there are cardinal rules to keep in mind while investing.

Diversification

The first rule is diversification. Rather than putting all your eggs in one basket, it’s important to spread your investment across different asset classes, sectors, and regions.

Why is this important? Markets can be unpredictable, with sectors or regions experiencing highs and lows. By investing across a broad spectrum, you limit your exposure to any single area. So if one part of your portfolio underperforms, the strong performance of other parts could help balance it out.

Whether you choose to pick individual shares or opt for a solution that does that for you (i.e. KiwiSaver, managed funds, or ETFs), keep this principle top of mind.

Reduced transaction fees

Reducing transaction fees is as important as choosing the right investment. Imagine if each week you took a bus to deposit your $20 into your investment account, but the bus ticket cost you $5. That's a quarter of your investment gone before it even reaches your account.

The same applies to investing. Fees can significantly eat into your investment, especially when dealing with smaller, frequent amounts. Always look for solutions that offer reduced transaction costs or even fee-free transactions for smaller amounts.

Consistency and patience

Patience and consistency are vital in investing. Keep in mind that you're investing for the long haul, and markets naturally have periods of ups and downs. Regular and consistent investments not only smooth out market highs and lows over time but also promote the habit of saving. Trust in the market's long-term growth trend, and let it do the heavy lifting for you.

Now for the important legal part: The information we provide is general and not regulated financial advice for the purposes of the Financial Markets Conduct Act 2013. Please seek independent legal, financial, tax or other advice in considering whether the content in this article is appropriate for your goals, situation or needs. The information in this article is current as at 18 June 2023.

Stephanie Pow

Founder & CEO of Crayon

Rupert Carlyon

Founder & Managing Director of kōura